Pix with Direct API

Overview

This guide will walk you through a basic API integration that accepts payments via Pix in EBANX.

note

PIX is offered by EBANX Instituição de Pagamento Ltda (Juno), which is a direct participant of the instant payment arrangement as specified in the Resolution nº1 of the Brazilian Central Bank.

About this guide

By following this basic integration guide, you will understand how you can accept Pix payments in your ckeck-out, by using EBANX Direct API. To complete a payment with Pix you will need a single API call that will create the payment and provide the necessary information for the customer to complete the transaction.

Availability

Pix integration through Direct API is available in Brazil only.

What you will need

A Sandbox Account

As with any secure payment integration, you will first need to set up authorization. The EBANX sandbox allows you to set up a test environment to run transactions using test credit card numbers and explore our payment solutions.

Sign up for an Sandbox Account at our EBANX Business Page, select your business model and answer a few questions. We'll get in touch with you shortly after!

Sign up for an EBANX Sandbox Account here

How it works

To complete a Pix payment, please follow the steps below.

Enable Pix in your dashboard

The first step is to check if Pix are active in your EBANX Dashboard.

All set? We can go ahead to next step, otherwise, please get in touch with our integration specialists.

Call the /ws/direct API to get the Pix link and QR Code

Pix provides the option of redirecting the customer to a voucher created by EBANX or to get the raw QR Code. To get this link, you just need to call the end-point

ws/direct(server-side) with the following required fields:- Operation: Must be

request; - Payment type code: Must be

pix;

Customer data:

- Customer name;

- Customer e-mail;

- Customer document;

- Customer address;

- Customer street number;

- Customer city;

- Customer state;

- Customer zip-code;

- Customer phone number

Charge info:

- Unique merchant payment code;

- Currency code (BRL or USD);

- Total amount to be charged;

- Expiration time in seconds

Check the example:

curl -X POST 'https://sandbox.ebanxpay.com/ws/direct' \-d 'request_body={"integration_key": "your_test_integration_key_here","operation": "request","payment": {"name": "José Silva","email": "jose@example.com","document": "853.513.468-93","address": "Rua E","street_number": "1040","city": "Maracanaú","state": "CE","zipcode": "61919-230","country": "br","phone_number": "8522847035","payment_type_code": "pix","merchant_payment_code": "a92253f29db","currency_code": "BRL","amount_total": 100"expiration_time_in_seconds": 3600}}'A successful request will return a JSON response like the one below. The Pix redirect link will be in the parameter

payment.redirect_url, and the QR Code will be the value ofpayment.pix.qr_code_value.{"payment": {"hash": "59ad5dd18a6d5ba0e24327c2ba92a730115a80bd58b3baa5","pin": "655158605","merchant_payment_code": "af461f512c1","order_number": null,"status": "PE","status_date": null,"open_date": "2017-09-04 14:06:09","due_date": "2017-09-04","confirm_date": null,"transfer_date": null,"amount_br": "100.38","amount_ext": "100.00","amount_iof": "0.38","currency_rate": "1.0000","currency_ext": "BRL","payment_type_code": "pix","redirect_url": "https://sandbox.ebanxpay.com/print/?hash=59ad5dd18a6d5ba0e24327c2ba92a730115a80bd58b3baa5","pix": {"qr_code_value": "00020101021226590014br.gov.bcb.pix2537pix-h.juno.com.br/qr/D762CC0E270360DF52040000530398654042.015802BR5910EBANX Ltda6008CURITIBA62240520JNPX2020110400000004630474D0"},"pre_approved": false,"capture_available": null},"status": "SUCCESS"}note

The complete API reference for the end-point

ws/directcan be found here. We strongly recommend you to take a look in all the available options.- Operation: Must be

Presenting the Pix QR Code

You can present the QR code in two different ways, by either redirecting your customer to our payment voucher (redirect_url), or by rendering the code at your page.

Redirect customer to our payment voucher (Recommended)

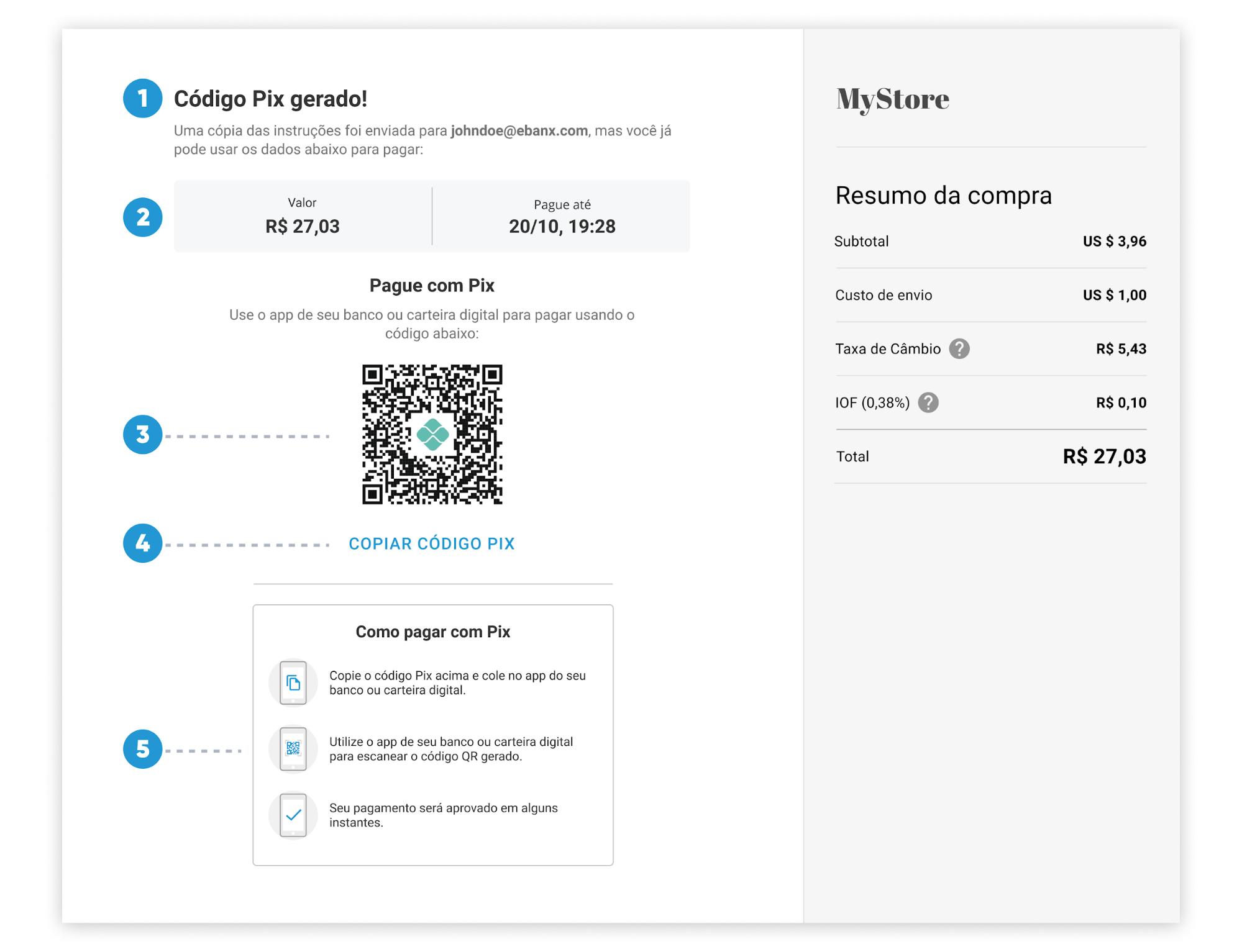

Redirect your customer to the URL returned in the parameter redirect_url. The experience will look like this:

You can also present this voucher in a modal, an iframe or in a webview, so the customer can pay without leaving your site or app.

Rendering the Pix QR code

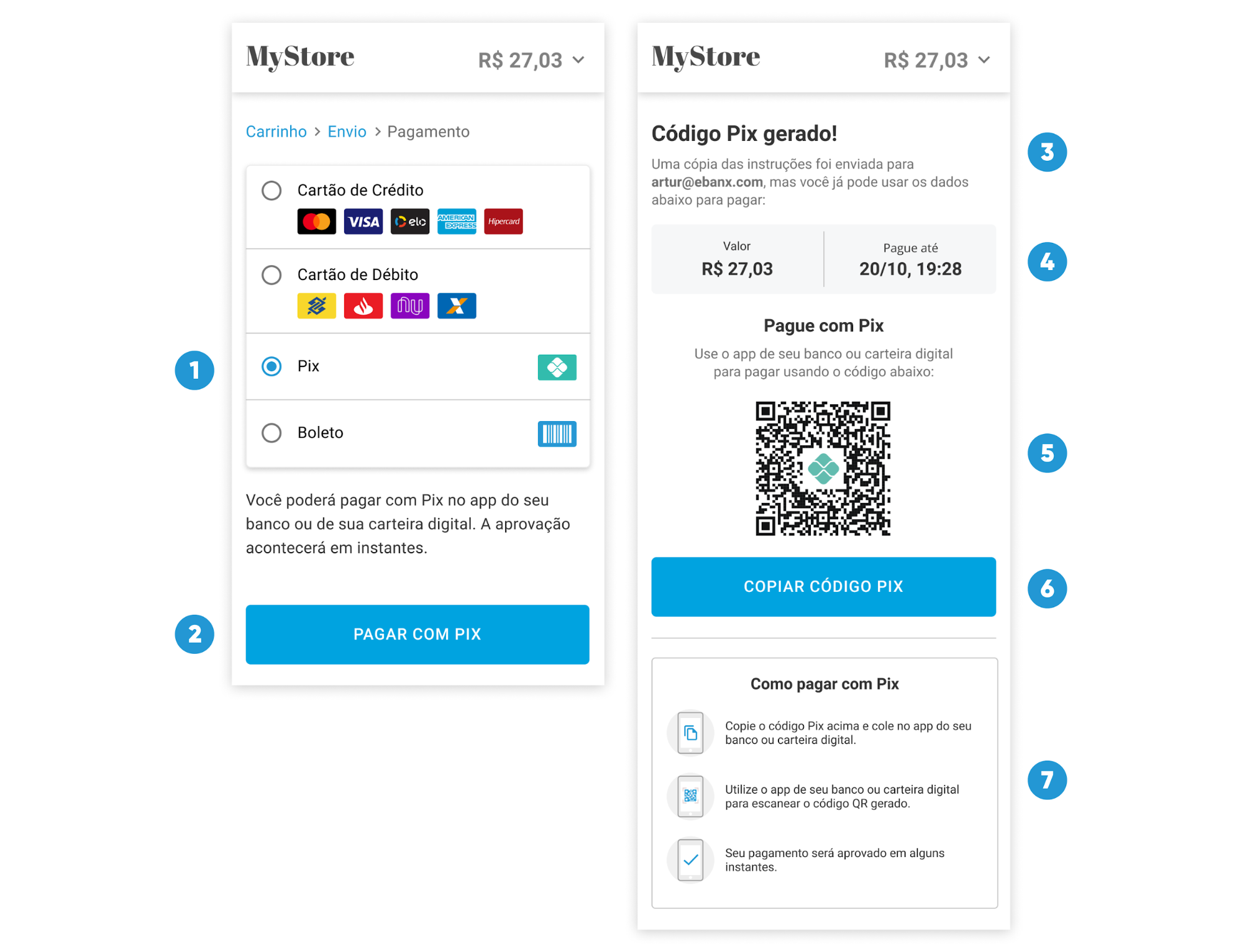

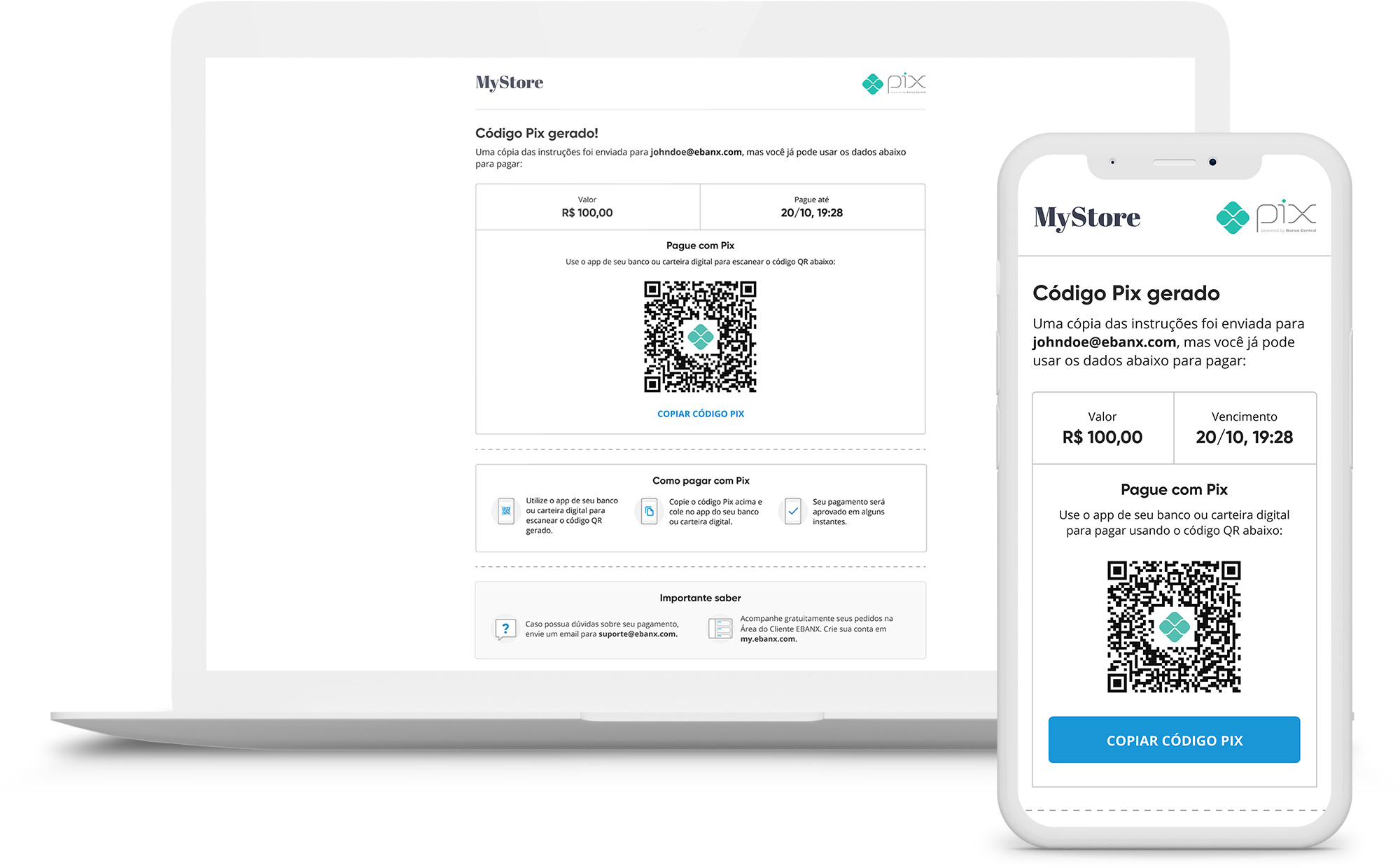

You can also render the payment information at your own page. The suggested experience can be seen below.

For DesktopFor Mobile DevicesCopying QR Code to Clipboard

Alternatively, you can simply deliver the QR Code number from

payment.pix.qr_code_valueto your customer's clipboard so they can paste it into their banking/wallet app.At this point you have a

pending(PE) payment in your EBANX Dashboard.Wait for the payment

As soon as we get the confirmation, payment status is modified from

pending(PE) toconfirmed(CO).Important!

Pix payments expire after 4 hours. If your customers don't complete the payment via pix in time, the payment will be automatically canceled.

Getting help

If you have any doubts or need help, you can send and email to: EBANX Integration