Online Debit with Direct API

About this guide

This page explains how to add Online Debit (TEF) to your existing Direct API integration. Direct API integration is basically the same for all payment methods, only varying the payment_type_code and some additional required fields.

If you are not integrated with EBANX Direct API yet, please take a look in this basic guide about it. Are you not sure if EBANX Direct API is the best option for your e-commerce? Please, talk with one of our integration specialists.

What you will need

Before starting your integration, please make sure that you have:

- An EBANX Sandbox account. That's not the case? Please sign up for an Sandbox Account here;

- Online Debit enabled in your EBANX Dashboard.

How it works

To complete Online Debit integration through EBANX Direct API, please follow the steps below.

Enable Online Debit

Online Debit availability may vary depending on your contract. So the first step is to check if it is active in your EBANX Dashboard.

All set? We can go ahead to next step, otherwise, please get in touch with our integration specialists.

Call the /ws/direct API to get the Online Debit link (server-side)

With Online Debit, your consumers are redirected to their online-banking website and the payment is made safely and quickly. To get this redirection link, you just need to call the end-point

ws/request(server-side) with the following required fields:Basic parameters:

Parameter Description operationOperation must be requestintegration_keyYour unique and secret integration key payment_type_codeSupported banks are: banrisul,bradesco,bancodobrasil,itauCustomer data:

Parameter Description nameCustomer name emailCustomer e-mail documentCustomer document addressCustomer address street_numberCustomer street number cityCustomer city stateCustomer state (Two letter code) zipcodeCustomer zip-code phone_numberCustomer phone number Charge parameters:

Parameter Description merchant_payment_codeUnique merchant payment code currency_codeCurrency code amount_totalTotal amount to be charged Optionally, you can set a due date to your voucher using the parameter

payment.due_datein the format dd/mm/yyyy. It can be more than three days only when payment currency isBRL(Brazilian Real), and your merchant account has this feature enabled. The due date is based on the local time of the country that the payment is generated.Check the example:

curl -X POST 'https://sandbox.ebanxpay.com/ws/direct' \-d 'request_body={"integration_key": "{{integration_key}}","operation": "request","payment": {"name": "José Silva","email": "jose@example.com","document": "853.513.468-93","address": "Rua E","street_number": "1040","city": "Maracanaú","state": "CE","zipcode": "61919-230","country": "BR","phone_number": "8522847035","payment_type_code": "itau","merchant_payment_code": "0x0W26D04-T03","due_date": "27/06/2020","currency_code": "BRL","amount_total": 100}}'A successful request will return a JSON response like the one below. The redirection link to the bank will be in the parameter

payment.redirect_url.{"redirect_url": "https://sandbox.ebanxpay.com/ws/directtefredirect/?hash=5ef50c977378a231f42da8c8d882264ba8251a31e781b33c","payment": {"hash": "5ef50c977378a231f42da8c8d882264ba8251a31e781b33c","pin": "489539812","country": "br","merchant_payment_code": "0x0W26D04-T03","order_number": null,"status": "PE","status_date": null,"open_date": "2020-06-25 20:44:07","confirm_date": null,"transfer_date": null,"amount_br": "100.00","amount_ext": "99.62","amount_iof": "0.38","amount_ext_requested": "100.00","currency_rate": "1.0000","currency_ext": "BRL","due_date": "2020-06-27","instalments": "1","payment_type_code": "itau","redirect_url": "https://sandbox.ebanxpay.com/ws/directtefredirect/?hash=5ef50c977378a231f42da8c8d882264ba8251a31e781b33c","pre_approved": false,"capture_available": null},"status": "SUCCESS"}info

The complete API reference for the end-point

ws/requestcan be found here. We strongly recommend you to take a look in all the available options.Redirect customer to the returned URL

Redirect your customer to the URL returned in the parameter

redirect_url. After the redirection, your customers will be in their online-banking environment, with all the necessary purchase details to finalize their payment securely and easily.At this point you have a

pendingpayment in your EBANX Dashboard.Sandbox environment

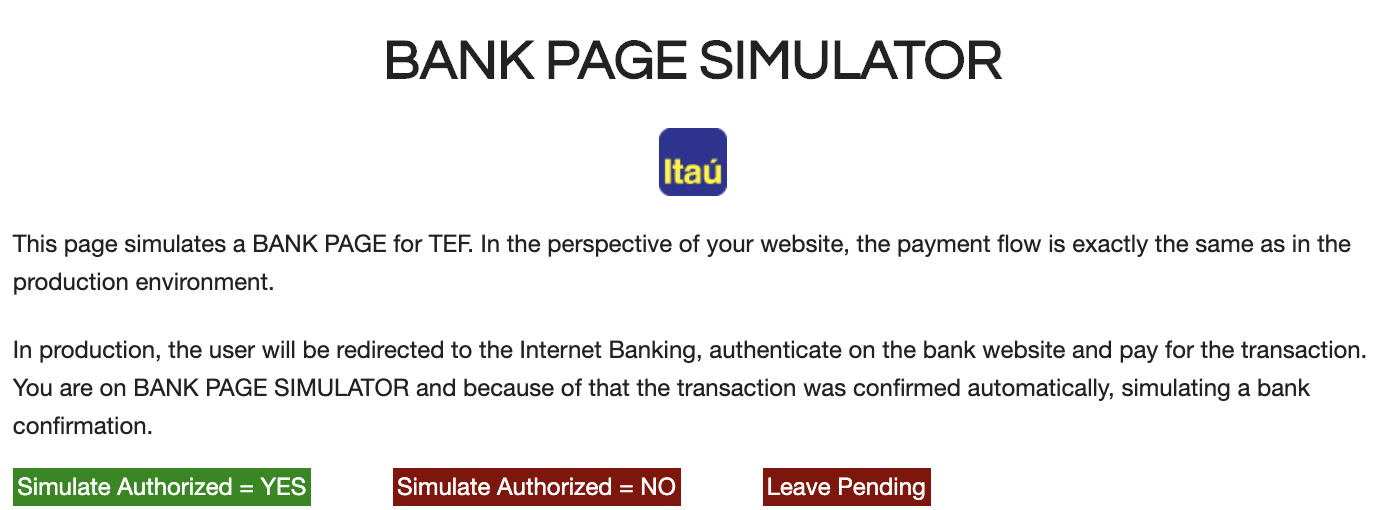

You can test this integration in our Sandbox environment as we offer a Online-Banking mock interface.

Check it below:

Wait for the payment

After the payment in the Customer's online-banking environment, it will take sometime to EBANX get informed by the bank. As soon as we get the confirmation, payment status is modified from

pendingtoconfirmed.If your customers don't conclude the payment, it will be automatically canceled.

Getting help

We hope this article was enlightening, but in case we’ve failed to take out your doubts you have the following options to keep on seeking for answers:

- If you’re not our partner yet and would like to know more about our prices and conditions please fill our this form and our commercial team will get in touch with you.

- In case you’re already our partner please get in touch with our support team at integration@ebanx.com.