Payouts Overview

What is a Payout?

The way people work is changing fast. People can work remotely and be part of international organizations without leaving their country.

This scenario created a new challenge for cross border companies: how to pay people the way they want to in their currency without being there? Regulation, compliance, taxes, local connections, and other things are needed to make this process smooth to both ends, and this is what EBANX is offering with this new payout product.

This is where Payout solutions come into play. A payout is the act of sending funds to a supplier, partners or a freelancer and helps merchants by:

- Providing fast payments

- Offering a single platform to attend multiple countries

- Reducing total number of transactions to perform a payment

- Providing a good experience to the payees

The EBANX Payout platform offers the following advantages:

- Competitive SLA. Payment occurs in D+3 business days

- Brazil, Chile, Colombia and Mexico coverage, soon to expand to other Latin America countries

- Reduced number of exchanges by using the settlement to perform the payout

Payout Types

We have 2 types of Payout. Your company will be using only one of them, the one that best fits your business.

Payment Analysis

In this type of payout you'll need to have a document to support each payment (apart from the payee's information needed). The supporting document could be a receipt/invoice, purchase order, contract, or another document that proves the relationship between you and the beneficiary.

Payee Analysis

This type of payout suits best business that have an agreement with the payee and can provide the date and time that the payee has accepted it. You will send only the information about the payee in the first moment, but once the payee receives a sum superior to the threshold amount (threshold default is 100 USD), we will get in contact with the payee and ask him for a copy of his documents. For individual users: Proof of identity and proof of address. For companies: Proof of company's identity, proof of company's address and proof of identity of the main shareholder (s).

The Payout Process

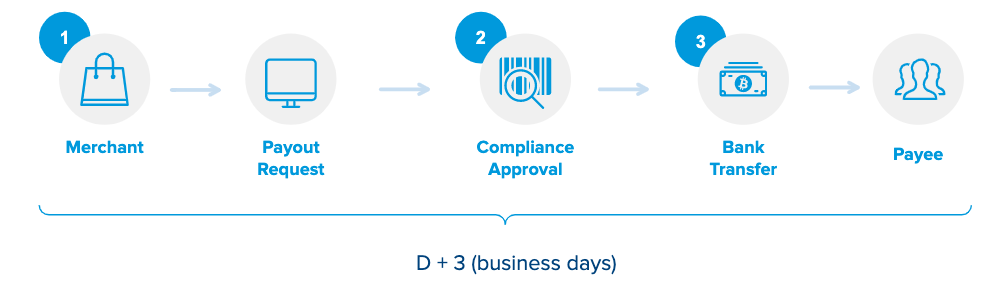

- Merchant requests payouts through EBANX Dashboard or API

- Compliance will analyze and approve the payee and the payment in D + 1 (business days)

- After compliance approval, the payee will receive the payment in 2 days (business days). If the bank information isn't correct, this SLA can be affected

The whole process (from payout request to payee payment) will occur in D + 3 (business days).

EBANX Payout Solutions

API: Our Payout API allows for full customization of the user experience according to the merchant's needs. This solution requires code development on the merchant's website.

Dashboard: EBANX's Dashboard offers a smooth experience without the need for any coding at all. Simply log on to your dashboard and check our payout features!